AI.Law Launches Groundbreaking Tool for Insurance Claims Analysis

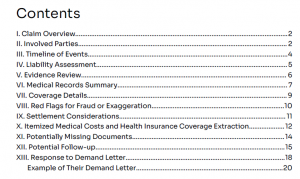

Adjusters can now upload entire claim files into AI.Law and get a complete 20-page report in under 10 minutes that includes everything they need from a file.

Revolutionizing Insurance Claims Management

AI.Law’s new claims analysis tool represents a significant leap forward for claims management systems. This advancement marks a turning point in how claims are handled, combining speed with precision. By combining cutting-edge AI technology with industry best practices, this tool streamlines the claims management process while improving accuracy and reducing processing time. Adjusters benefit from a user-friendly interface that simplifies complex tasks and enhances productivity. The tool enables adjusters to upload entire claim files into the AI.Law platform, simplifying data analysis and generating comprehensive reports. These reports are structured to provide clear insights that are easy to interpret and act upon. This approach eliminates the need for manual review, enabling adjusters to focus on critical decision-making and customer service. The automation also reduces human error, ensuring consistency across all claims.

Seamless Drag-and-Drop Functionality

Adjusters can simply upload entire claim files into the AI.Law platform, streamlining data analysis and report generation for greater efficiency. The intuitive design makes it accessible even for those less familiar with advanced technologies. This includes policies, police reports, witness recordings, medical records, and property reports. By centralizing all relevant documents, the platform ensures nothing is overlooked during analysis. Once uploaded, the AI holistically reviews the data and generates detailed reports. These reports synthesize information from multiple sources, offering a comprehensive view of each claim. These reports provide coverage analysis, liability assessments, medical summaries, fraud detection, and pre-drafted responses to demand letters. These insights empower adjusters to make informed decisions swiftly and confidently. This functionality significantly accelerates the claims process, reducing cycle times and improving customer satisfaction. Faster processing times contribute to higher customer retention and improved operational metrics.

Features Highlighted from AI.Law’s Website

Three key features are provided in greater detail on the AI.Law Insurance page and include: how ai in insurance claims is now easier with a platform designed to meet the evolving needs of insurance carriers by improving operational efficiency and enhancing claims management systems and processes. The flexibility of the platform ensures it adapts to a variety of use cases within the industry. The tool minimizes errors through standardized claim evaluation, ensuring consistent and accurate reviews. This standardization helps maintain compliance and reduces the likelihood of disputes. It improves efficiency by drastically reducing the time required for claims processing, enabling adjusters to handle more claims without increasing staff. This scalability makes it an ideal solution for carriers experiencing growth. Additionally, it generates significant savings by identifying claims leakage at the liability stage, helping carriers avoid costly errors and improve profitability. By addressing key pain points, the tool helps insurers maintain a competitive edge.

Addressing Key Industry Challenges

The insurance industry faces constant pressure to reduce leakage—the financial losses incurred due to errors, inefficiencies, or overpayments. Leakage can result in substantial financial losses, impacting both short-term and long-term profitability. Leakage not only impacts profitability but also undermines the overall effectiveness of claims operations, making it a top priority for insurers. Identifying and addressing leakage is critical for maintaining trust and operational integrity. AI.Law’s tool addresses these challenges by pinpointing overpayments and avoidable errors, providing clear guiderails for junior adjusters, and delivering actionable insights that enable informed decision-making. The AI-driven insights also enhance transparency, making it easier to identify areas for improvement. By streamlining the claims process, the tool ensures a more efficient and accurate approach to claims management. This leads to better outcomes for both insurers and their clients, fostering long-term loyalty.

Empowering Insurance Professionals

AI.Law’s platform is the result of extensive collaboration with industry experts. This ensures the platform is not only technologically advanced but also grounded in real-world practicality. This unique approach ensures that the tool integrates seamlessly into existing workflows while leveraging deep domain expertise to address the most pressing challenges in claims management. The result is a tool that is both powerful and user-friendly, bridging the gap between technology and human expertise. By automating repetitive tasks and offering clear, data-driven insights, AI.Law empowers adjusters to resolve claims faster, reduce cycle times, and improve customer satisfaction. These efficiencies allow teams to reallocate resources to higher-value tasks, driving greater organizational impact. The platform’s customizable workflows and patent-pending speed make it a critical asset for insurance companies looking to enhance efficiency and accuracy. The ability to tailor the platform to specific needs ensures it delivers maximum value.

Start Saving Time and Money Today

Insurance carriers interested in revolutionizing their claims process can book a demo of AI.Law’s claims analysis tool. The demo provides an in-depth look at how the platform can transform day-to-day operations. Discover how AI.Law empowers adjusters to work smarter, reduce errors, and accelerate claims resolution—bringing unparalleled efficiency and accuracy to your team. The platform’s intuitive design ensures a smooth adoption process for teams of all sizes. Visit AI.Law’s Insurance Page to learn more and schedule a consultation. This is an opportunity to stay ahead in a competitive market by leveraging cutting-edge technology.

With AI.Law, insurance companies can reduce leakage, improve efficiency, and handle claims with precision—all while enhancing customer satisfaction and reducing costs. The platform’s proven results make it a must-have for any carrier aiming to stay competitive in the modern insurance landscape.

Troy Doucet

AI.Law

+1 614-379-2499

email us here

Customizable Reports for Insurance Claims Adjusters and Lawyers

Distribution channels: Healthcare & Pharmaceuticals Industry, Insurance Industry, Law, Real Estate & Property Management, Telecommunications

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release