Industrial Valves Market to USD 114 Billion by 2031 Driven by Rising Automation and Smart Technology Integration

Flowing Forward: Exploring the Industrial Valves Market Dynamics

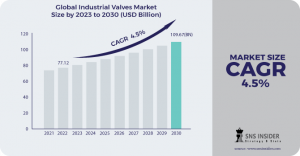

TEXES, AUSTIN, UNITED STATES, June 12, 2024 /EINPresswire.com/ -- The Industrial Valves Market Size reached a value of USD 79.86 Billion in 2023 and is projected to surge to USD 114 Billion by 2031, reflecting a CAGR of 4.5% over the forecast period of 2024-2031.Download Sample Copy of Report: https://www.snsinsider.com/sample-request/1862

Top Key Players:

Emerson Electric

Schlumberger

Flowserve Corporation

IMI plc

Neles Corporation

Spirax Sarco Limited

Crane

Conbraco Industries Inc

Kitz Corporation

Trillium Flow Technologies

Bray International

Surging Industrialization and Automation to Fuel Industrial Valves Market Growth

This growth is primarily driven by the increasing automation across industries, coupled with the expanding need for advanced flow control equipment. Smart valves with intelligent control systems are gaining traction, further accelerating market development. Industrialization and facility expansion are leading to increased automation, propelling the need for efficient industrial valves for flow control.

Advancements in smart valves, particularly for subsea oil & gas applications, are enhancing system reliability and responsiveness. These valves boast embedded processors and network capabilities, enabling better performance in harsh environments.

Segmentation Analysis: Ball Valves dominate the market

Ball valves currently dominate the market, accounting for over 19% of the revenue share in 2024. Their popularity stems from their versatility in flow control and tight shut-off capabilities, making them ideal for various applications such as circulating systems on ships, chlorine manufacturing, and fire safety applications.

Butterfly valves have witnessed a significant rise in demand recently, particularly within the oil and gas industry. This is due to the increasing exploration and upgrade activities fueled by substantial investments in pipelines and refineries.

Check valves are also experiencing steady growth, with a projected CAGR exceeding 7% over the next seven years. Their unidirectional flow control prevents process flow from returning to the system, safeguarding equipment and preventing process disruptions. Rising automation and the need for controlled fluid flow within refineries have positively impacted demand across various industries.

Impact of Economic Slowdown and Russia-Ukraine War

The Russia-Ukraine war has disrupted global supply chains, impacting the availability of raw materials and components needed for valve manufacturing. This disruption, coupled with rising energy costs, could potentially hinder market growth in the short term. However, long-term prospects remain positive, driven by the aforementioned growth factors.

Economic slowdowns can also pose challenges. For instance, a potential slowdown in China, a major consumer of industrial valves, could temporarily dampen market growth. However, the long-term outlook remains optimistic due to the underlying demand drivers in other regions.

Regional Focus: Asia Pacific Takes the Lead

The Asia Pacific region currently holds the dominant position in the industrial valves market, exceeding USD 20 billion in 2014. This is primarily driven by the region's booming construction activities and rising chemical consumption. Additionally, the construction of new nuclear power plants and capacity expansion in petroleum refineries are expected to further stimulate demand. China, for instance, is projected to invest heavily in building coal-fired power plants equipped with scrubbers.

North America presents another significant growth market. The surge in shale gas and oil sand production creates a lucrative environment for valve manufacturers. Replacing outdated and inefficient valves in existing gas transportation infrastructure is expected to bolster overall demand in the region. The shale gas revolution in the U.S., leading to increased exploration and production investments, is a key driver of market growth. Additionally, the growing adoption of renewable energy sources bodes well for the future of the market.

Europe, while exhibiting slower growth compared to other regions, holds potential due to the development of offshore oil & gas sites and burgeoning demand from Russia in the midstream segment.

Buy Complete Report: https://www.snsinsider.com/checkout/1862

Recent Development

In February 2024, Burkert launched a new range of tool-free, easy-to-service valves designed for controlling liquids and steam.

In April 2024, Sloan Valve Company launched advanced and sustainable restroom solutions for residential, commercial, industrial, and institutional sectors.

Key Takeaways

Insights into the growing demand for industrial valves, particularly within the automation, oil & gas, and power generation sectors.

Understanding the trends in smart valve technology and the integration of IoT and AI.

The report sheds light on potential challenges like geopolitical disruptions and economic slowdowns.

In-depth analysis of regional trends, dominating segments, and key growth drivers in Asia Pacific, North America, and Europe

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Instagram

YouTube

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.