Financial Literacy Missing from Financial Wellness Programs; Finasana Fills the Gap

Financial literacy is the backbone on long-term financial success. Finasana for Business delivers a uniquely proactive solution fine-tuned for engagement.

Finasana For Business offers a uniquely proactive solution that equips employees with the tools they need to navigate the increasingly complex maze of money management. The web platform and mobile app are intuitive, built for busy people, and designed to drive engagement with 4-minute-long video and audio lessons exploring fundamental personal finances topics in easy-to-understand language.

“Financial wellness plays a critical role in our mental health and overall well-being,” says Gabi Slemer, Founder of Finasana.

“But maintaining the sense of security and control that comes with financial wellness means making the right decisions every single day. You can’t have long-lasting financial wellness without financial literacy.”

Unlike many financial wellness benefits, Finasana for Business is not reactive. Instead, the platform’s content takes a preventative approach, empowering employees to cultivate healthy money habits that compound over time to minimize stress.

“Financial wellness is the end goal. Financial literacy is a tool we can use to get there and stay there,” says Gabi.

“One-on-one crisis management can help someone get out of a really bad financial situation. But without a basic understanding of personal finances, that person could easily fall right back into the same financial traps.”

Financial literacy is positively correlated to financial resilience. Findings from the National Bureau of Economic Research show that greater financial literacy increases an individual’s capacity to overcome not just personal setbacks but also macroeconomic challenges like the COVID-19 pandemic.

With a robust financial vocabulary and knowledge base to draw from, people can actively participate in their finances and make decisions that bring them closer to their short- and long-term goals.

One of Finasana’s users has avoided working with a financial advisor because she felt she didn’t have the language or understanding to evaluate their recommendations. “I don’t know enough myself so I don’t want to pay a ton of money to have someone tell me things that I can’t evaluate,” she said.

But even with the quantity of information freely available online, financial literacy remains unattainable for many. People may not have the time, patience, or inclination to sift through lengthy, disjointed articles or watch hours-long lectures riddled with jargon. Further, for some, the present bias – favoring smaller immediate wins over larger future rewards – can lead to a tendency to ignore or disengage from their financial situation.

Finasana faces those challenges head-on, resulting in a product fine-tuned for maximum uptake and engagement.

“We know people are busy. We know they might find financial topics boring. Our lessons are bite-sized and cater to different learning styles so that employees can watch, listen, or read our content whenever, wherever,” says Gabi.

“By connecting abstract financial concepts to relatable real-life scenarios, we flick a switch in our users’ minds. All of a sudden, they get why financial literacy is so important. Gamified progress tracking, hands-on activities, and interactive quizzes keep people coming back to our platform.”

In addition to financial planning, coaching, and debt management, a complete and functional financial wellness program must include financial literacy. Knowledge is foundational to financial success, and Finasana for Business enhances the overall effectiveness of companies’ existing financial wellness programs.

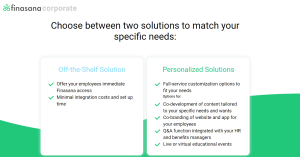

Businesses can implement the off-the-shelf solution or collaborate with Finasana’s team of industry experts to create a fully customized, bespoke financial literacy program.

Find out more about Finasana For Business at business.finasana.com.

About Finasana:

Finasana is an online financial wellness and literacy platform. Finasana’s short, curated video and audio content, hands-on activities, and quizzes empower subscribers to reclaim control of their finances. Finasana champions simplicity and accessibility to make financial literacy attainable for everyone through six categories: investing, budgeting, financial wellness, saving, spending, and borrowing.

Mia Slater

Finasana

press@finasana.com

Visit us on social media:

Facebook

LinkedIn

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.